It’s TAX Season!

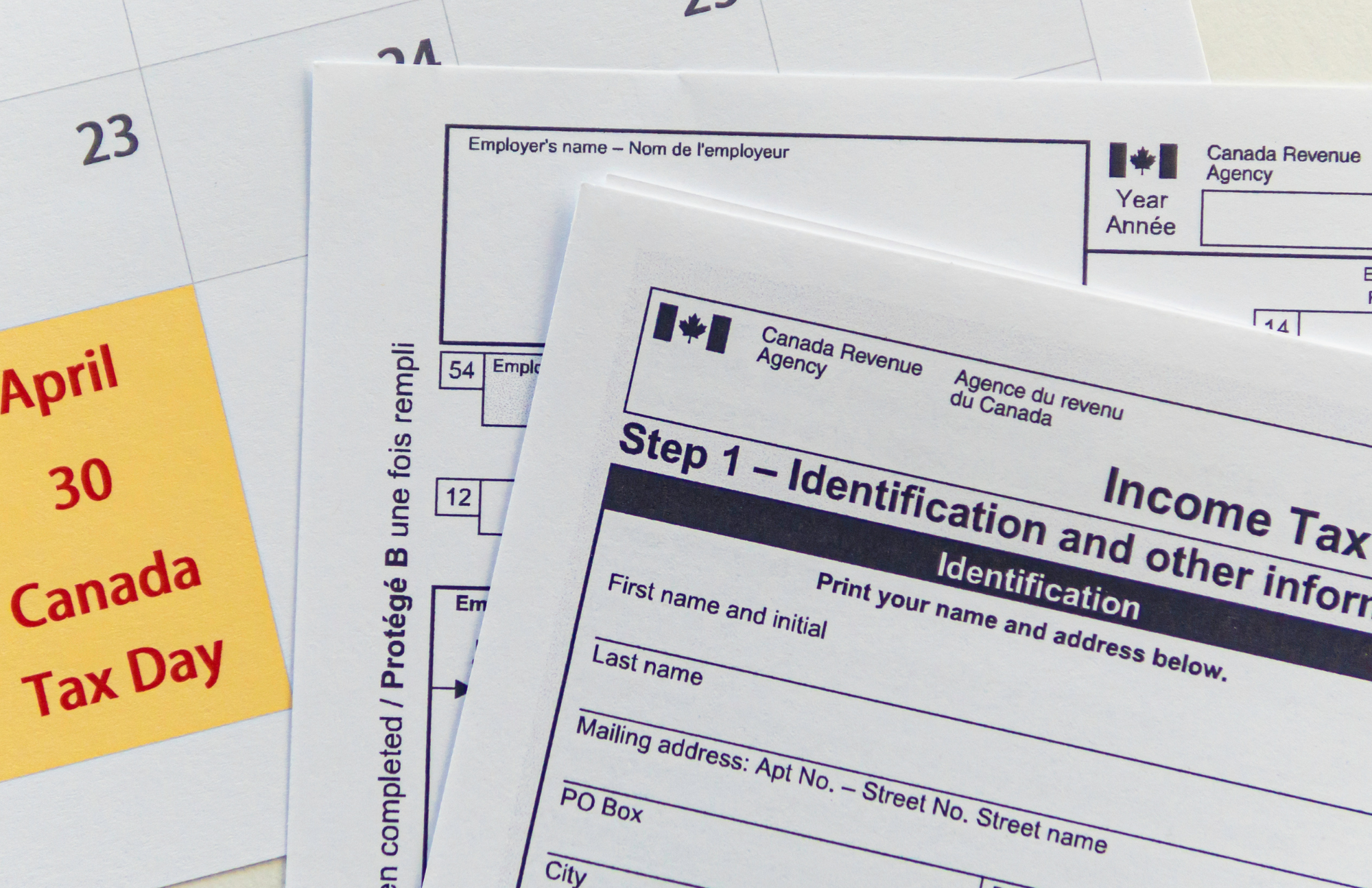

April 30 – Canada Tax Day. Photo credit: Osarieme Eweka via Getty Images.

When to file your taxes?

Taxes can be filed as early as February 19, 2024. The deadline for tax filing for most Canadian residents is April 30, 2024.

Who is eligible to file taxes this year?

There is no minimum income requirement or age limit for filing taxes, and it is generally advised to do so regardless of your employment status. If your annual income for the tax year exceeds the basic personal amount (typically $15,700), you should file taxes. However, to make the most of tax credits and refunds, especially during student life, it’s advisable to file taxes as long as you’re residing in Canada. This applies regardless of your age, income, or status in Canada.

Why File Taxes?

- You can receive $496 or more in GST/HST refundable tax credits, even if you were not employed anywhere for the entire year.

- Tuition and Textbook Non-Refundable Tax Credits: Students can reduce the amount of money they owe to the government by claiming tax credits for tuition, textbooks, and other educational expenses.

- International students can use their previous tax returns when applying for Permanent Residency to demonstrate their ties to Canada.

- Registered Retirement Savings Plan (RRSP) Contribution Room: While retirement might seem far off for students, it’s never too early to plan ahead. Each time you file your taxes, your RRSP contribution limit increases, allowing you to invest more.

How to file taxes?

Returning students who have previously filed taxes can simply register themselves on the CRA My Account portal to file their tax returns online. They can register for the portal based on the notice of assessment they received after filing taxes previously. In addition, like new students/immigrants, they can also make use of the free community tax clinic.

New students who have never previously filed a tax return will be unable to file taxes using the online portal.

The new students will need to file tax returns by paper with the help of the community tax clinic or tax clinic at UPEI (appointments begin 1st week of March).

Documents Needed to File Taxes:

- Social Insurance Number (SIN): If you don’t have a SIN, you can get one issued at the Service Canada office.

- Income Tax Slips: If you worked in the last fiscal year, you should have a T4 slip. Your employer should provide this document.

- Interest Slips: You must declare income earned through interest using a T3 or T5 slip. These slips can be obtained from your bank.

- Tuition Receipt T2202A: This document details the annual tuition paid and the number of months you attended university. It can be accessed via MyUPEI, after February 28th.

- Donation Receipts: If you have made donations to a Canadian charity, you should include these receipts.

- Medical Receipts: Keep track of any medical expenses not covered by insurance or your health card.

- Other Income Documents: Any other slips or documents indicating income besides employment and interest slips should also be included.

Protect Yourself from Fraud:

During this time of the year, cases of scammers pretending to be the Canada Revenue Agency (CRA) increase dramatically. It’s critical to stay informed and updated to protect ourselves from phishing.

The CRA will never:

-

- Request prepaid credit cards or gift cards.

- Ask for information about your passport, health card, or driver’s license.

- Leave personal information on your answering machine or voicemail, or ask you to leave such a message.

- Ask you to provide personal information via email.

- Send or request e-transfers of any kind.

Volunteer at the Tax Clinic: If you consider yourself knowledgeable about taxes, consider applying to volunteer at a tax clinic.

You’ll receive a certificate and gain valuable experience that could help with future career opportunities. While the international office has enough volunteers this year, keep an eye on your email to apply for next year!

By: Syed Imran,

Managing Editor